2025 Tax Brackets Single Filer

2025 Tax Brackets Single Filer. In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year. In 2023 and 2025, there are seven federal income tax rates and brackets:

Page last reviewed or updated: For instance, the 10% rate for a single filer is up to and including $11,000.

Last Updated 21 February 2025.

As a result, the tax brackets for 2025 are different than the 2023.

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $609,350 For Single Filers And Above.

10%, 12%, 22%, 24%, 32%, 35% and 37%.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

Images References :

Source: legraqfanchon.pages.dev

Source: legraqfanchon.pages.dev

2025 Tax Brackets Single Filer Tool Libby Othilia, Estimate your 2023 taxable income (for taxes filed in 2025) with our tax bracket calculator. As a result, the tax brackets for 2025 are different than the 2023.

Source: ishowspeedd.com

Source: ishowspeedd.com

Federal Tax Revenue Brackets For 2023 And 2025 ishowspeedd, Last updated 21 february 2025. Up to $11,600 (was $11,000 for 2023) — 10% more than $11,600 (was $11,000) —.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, That puts him in the 22% tax bracket. Page last reviewed or updated:

Source: rezfoods.com

Source: rezfoods.com

2022 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, For the 2023 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly. For the 2023 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

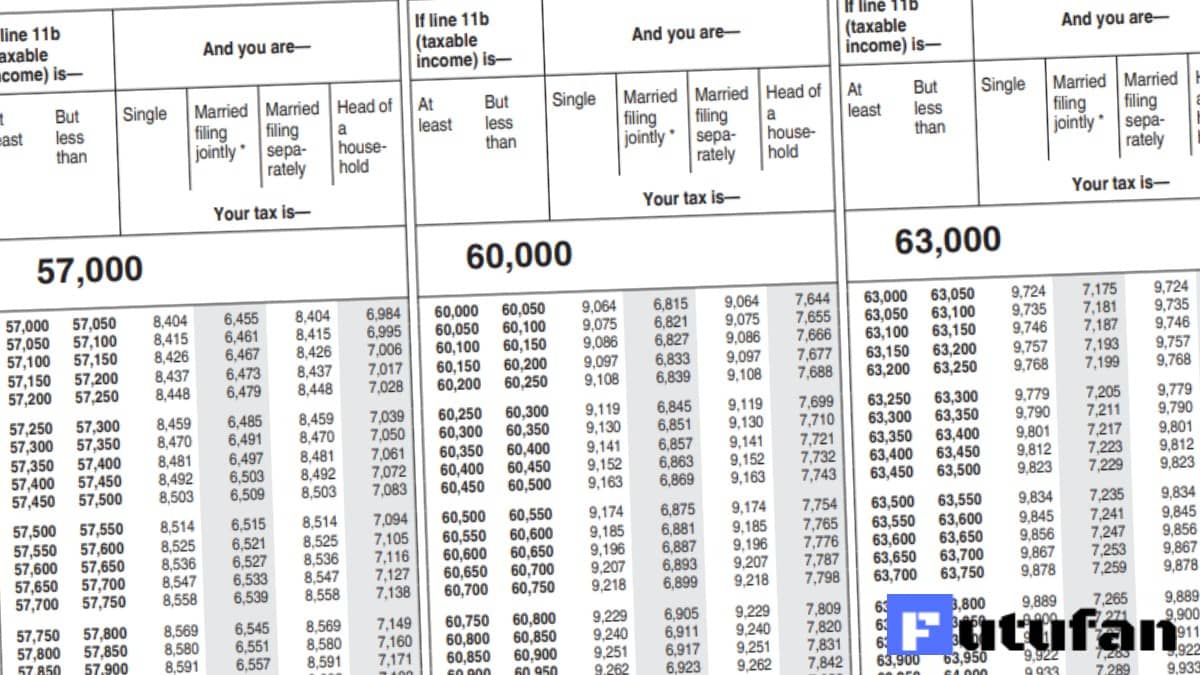

IRS Tax Tables 2021 Tax Tables Federal Federal Withholding Tables 2021, Here in the u.s., we have what’s called a progressive tax system. For the 2023 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status.

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, So how do the tax brackets and deductions work? For the 2023 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Tax brackets are adjusted by the irs each year to take inflation into account. In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, See the tax rates for the 2025 tax year. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: www.zrivo.com

Source: www.zrivo.com

Nebraska Tax Brackets 2025, There are seven (7) tax rates in 2025. For the 2023 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

20232024 Tax Brackets and Federal Tax Rates NerdWallet, How federal tax brackets work; The income levels are based off taxable income, not gross income or adjustable gross income.

Based On The 2023 Tax Brackets For A Single Filer And An Income Of $100,000, Alex Would Owe $17,400 In Taxes For The Year.

For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

See The Tax Rates For The 2025 Tax Year.

10%, 12%, 22%, 24%, 32%, 35% and 37%.